> 88%

of digitized processes

For us, your success is also our success.

We integrate with our stakeholders and carry out our plans with determination and agility. We build close and personal relationships. With daily communication and monitoring of each process and result. This discipline of monitoring and reporting extends to our investors. Our management is characterized by a clear and adaptable methodology, offering customized solutions to the challenges of each project.

We are united in this. That’s why we are always there.

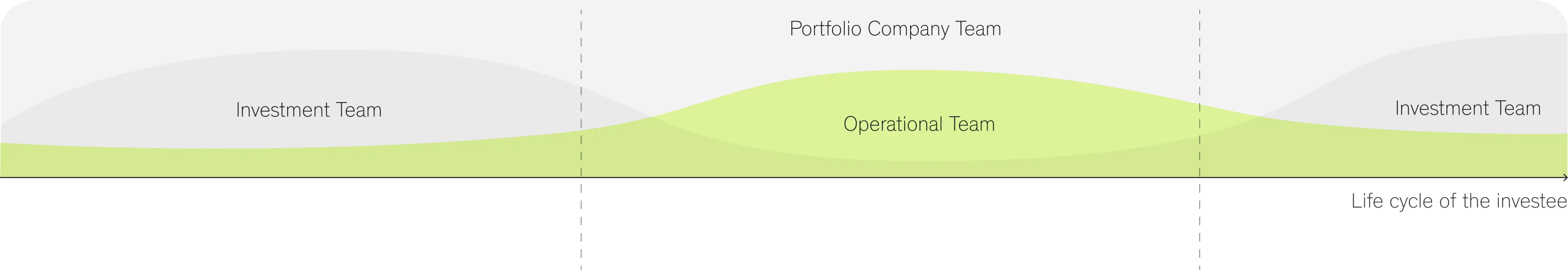

Having our own methodology, The Together Way, and 50% of the team working day-to-day with the company’s executive team, allows us to achieve the best returns. Thanks to our work process, perfected over more than 14 years, we can multiply long-term value, transforming the business model of the companies we invest in.

This is our way of working.

1 INVESTMENT

2 GROWTH

3 EXIT

SOURCING

ACQUIRE

OPTIMIZE

BOOST

EXIT

1 INVESTMENT

2 GROWTH

3 EXIT

SOURCING

1

ACQUIRE

2

OPTIMIZE

3

BOOST

4

EXIT

5

Nuestro sólido networking nos facilita identificar Deals y oportunidades que otros no ven en una etapa temprana.

Un modelo exhaustivo de análisis y la velocidad en la identificación de aspectos clave del negocio agilizan la toma de decisiones.

Nuestra política de ESG recoge actividades excluidas y evitadas en esta fase.

For over 20 years we have developed trusted relationships with an extensive network of professionals from different sectors and activities:

El trabajo en equipo de ambas áreas, durante la elaboración de la tesis de inversión y Due Interna, nos da la profundidad necesaria para poder evaluar los riesgos y las oportunidades eliminando las barreras de entrada.

Una información bien estructurada y detallada ayuda a asegurar la viabilidad futura de los planes de acción.

Somos ágiles y transparentes en la toma de decisiones y ofrecemos certidumbre de cierre.

Our investment thesis covers 4 main points:

1. Mercado: palancas de crecimiento

a. Cadena de valor sectorial

b. Análisis de unidades de negocio

c. Business Unit Market Analysis

2. Propuesta de Valor

a. Factores clave de éxito de cada Mercado y GAP que tengo

b. Posición competitiva

c. Value proposition vs. current value proposition

3. Performance

a. Mapa de procesos de la compañía

b. Análisis de los procesos

c. Risk vs Benefit Matrix

4. ESG

a. Escrutinio sobre prioridades ESG

Nos integramos con el equipo de la participada para implementar la tesis de inversión con una implicación total desde el día 1.

Esta fase se caracteriza por la rapidez en la ejecución de los planes de transformación y crecimiento, la claridad de la información y el seguimiento de indicadores para todo el ecosistema Sherpa.

100 DAYS PLAN

IMPLEMENTATION PLAN

1.Growth

2. Operational Excellence

3. Digitization

4. Culture, talent & ESG

5. ESG

We create and consolidate value and a differential business model, identifying new add-ons. We build a long-term sustainable growth plan.

The Together Way is a 360º delivery model that generates high returns to our entire ecosystem:

Our exit process focuses on 3 key aspects:

We create value relationships, not reporting.

Our figures are not just numbers.

They are the result of our work.

They speak of how we understand the complexity of each business.

How we face challenges. We overcame them. And at what speed. We overcame them. And at what speed.

> 3x

growth in EBITDA

+ 18

Add ons

+ 34%

job creation

> 88%

of digitized processes

> 85%

of companies in internationalization processes

> 3x

growth in EBITDA

+ 18

Add ons

+ 34%

job creation

> 88%

of digitized processes

> 85%

of companies in internationalization processes

Because no two companies are alike, there is no single way to implement it. We do it “ad hoc” for each one of them. We are especially quick to take their measurements. To listen. To understand. En definir y aplicar una estrategia única para cada una.

Nuestro background operacional nos permite desarrollar planes adaptados, garantizando la escalabilidad y evolución del negocio.

We co-create and implement action plans together with the investee’s team through a systematized methodology.

Our Operations area is structured in different levels: Operating Partner, Operating Director and Operating Manager. This multi-layer configuration, which combines different capabilities and specialties in Operations, Finance and Business, allows us to address transformation projects with greater depth and efficiency.

The relationship with our investees is also organized in 3 management levels: Weekly (management KPIs), Monthly (Business KPIs), Quarterly (value generation KPIs).

Play